Mẹo về Which of the following accounts would be closed to the income summary account the end of period? 2022

Bạn đang tìm kiếm từ khóa Which of the following accounts would be closed to the income summary account the end of period? được Cập Nhật vào lúc : 2022-08-25 07:35:06 . Với phương châm chia sẻ Thủ Thuật Hướng dẫn trong nội dung bài viết một cách Chi Tiết 2022. Nếu sau khi đọc nội dung bài viết vẫn ko hiểu thì hoàn toàn có thể lại Comments ở cuối bài để Tác giả lý giải và hướng dẫn lại nha.- Which of the following accounts should be closed to income Summary the end of the fiscal year ??

- Which of the following accounts should be closed to income Summary the end of the fiscal year *?

- What account do you close income Summary to?

- What accounts need to be closed the end of the accounting period?

- Which of the following accounts should be closed to income Summary the end of the fiscal year quizlet?

- Which of the following accounts should be closed to the income summary account?

- Which of the following accounts would be closed to the income summary account the end of the accounting period?

- Which of the following accounts should be closed to income Summary the end of the fiscal year service revenue?

- Which of the following accounts is not closed to income Summary account the end of the accounting period?

- Which of the following accounts should be closed to income Summary the end of the fiscal year *?

- What account do you close income Summary to?

- What accounts need to be closed the end of the accounting period?

- Which of the following accounts should be closed to income Summary the end of the fiscal year quizlet?

- Which of the following accounts should be closed to the income summary account?

- Which of the following accounts would be closed to the income summary account the end of the accounting period?

- Which of the following accounts should be closed to income Summary the end of the fiscal year service revenue?

- Which of the following accounts is not closed to income Summary account the end of the accounting period?

- Explanation of Income Summary Account

- Example of Income Summary Account

- How to Use the Income Summary Account?

- How to Close Income Summary Account?

- Disadvantages

- Recommended Articles

- Which of the following accounts would be closed to the income summary account the end of Aperiod?

- Which of the following accounts should be closed to the income summary account the end of the fiscal year?

- Which of the following accounts should be closed to the income summary account?

- Which of the following accounts would be closed the end of an accounting period?

Which of the following accounts should be closed to Income Summary the end of the fiscal year? The correct order for closing accounts is: revenue, expenses, income summary, withdrawals.

Which of the following accounts should be closed to income Summary the end of the fiscal year *?

Revenue and expense accounts

What account do you close income Summary to?

retained earnings account

What accounts need to be closed the end of the accounting period?

In accounting, we often refer to the process of closing as closing the books. Only revenue, expense, and dividend accounts are closednot asset, liability, Common Stock, or Retained Earnings accounts.

Which of the following accounts should be closed to income Summary the end of the fiscal year quizlet?

Which of the following accounts should be closed to Income Summary the end of the fiscal year? The correct order for closing accounts is: revenue, expenses, income summary, withdrawals.

Which of the following accounts should be closed to the income summary account?

Revenue and expense accounts

Which of the following accounts would be closed to the income summary account the end of the accounting period?

The correct answer is A. Only expenses such as depreciation expense, and revenues are closed in the Income Summary

Which of the following accounts should be closed to income Summary the end of the fiscal year service revenue?

Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings. The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account.

Which of the following accounts is not closed to income Summary account the end of the accounting period?

The correct answer is A. Only expenses such as depreciation expense, and revenues are closed in the Income Summary

The income summary account is defined as the account of temporary or provisional in nature wherein the statement the end of the accounting period net off all the closing entries of expenses and revenue accounts. The final, or the arriving balance, reports the statement profit or loss. If the final netted balance displays a credit, then the business has made a profit for that accounting year, and if the final netted balance is debit, then the business has made a loss corresponding to that accounting year.

Explanation of Income Summary Account

The income summary account is basically a temporary statement that documents and summarizes the income and the expenses that the business has earned and incurred from the non-operating and operating activities for a given accounting period. It is also regarded as the summary of revenue and expenses. There are generally two components of the income summary statement, namely the debit side and credit side.

The business is said to make profits if the credit portion of the income summary statement is more than the debit side of the income summary statement. Similarly, the business is said to make losses if the debit portion of the income summary statement is more than the credit side of the income summary statement. All temporary accounts of revenue and expenses have to be first transferred into the temporary statement of income and summary account. The balances in each of the temporary accounts would then be closed out in either capital account as applied for sole proprietorship business and retained earnings as applied for the corporation. The professionals should not be confused with the income statement, and income summary account as both of the concepts rely on the reports of income and losses earned and incurred by the business.

The income statement generally comprises permanent accounts and displays the business’s income earned and expenses incurred by the business. The income summary is a summarization and compilation of temporary accounts of the revenues and expenses. The information from the income statement can be transferred to the income summary statement to establish whether a business made a profit or loss. Whenever such a thing happens, the accounts in the income statement are debited, and accounts in the income summary are credited. It is to be noted that the income statement helps in the recording of the expenses and incomes in one broad sheet, whereas the income summary lists the closing amounts or records for the expenses incurred and sales generated by the business for a given accounting period.

Example of Income Summary Account

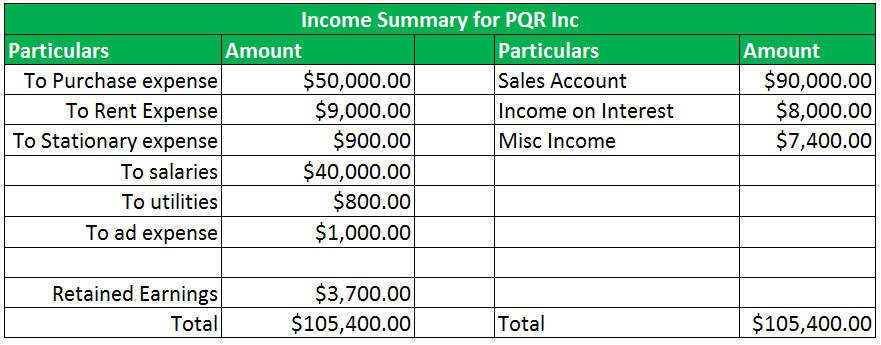

Let us take the example of PQR corporation. The business has earned interest income of $8,000, revenues of $90,000, and miscellaneous income of $7,400. The business incurred a purchase expense of $50,000, rent expense of $9,000, stationary of $900, ad expense of $1,000, the expense of utilities $800 with salaries as $40,000. Help the management prepare the income summary for the financial year ending.

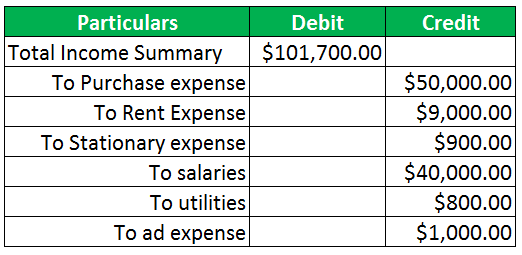

The following would be the journal entry that displays the transfers of the amounts from revenue accounts to the income summary: –

The following would be the journal entry that displays the transfers of the amounts from expense accounts to the income summary: –

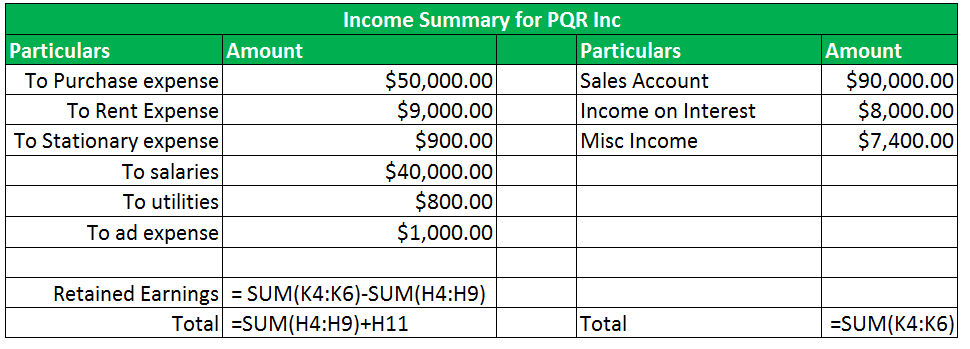

The following would be the computations on the income summary: –

The following would be the final income summary as displayed below: –

How to Use the Income Summary Account?

The income summary account is a very useful statement. It helps in maintaining the overall audit trail of revenues earned by the business and the expenses incurred by the business. The business and auditors can always go back to such statements to determine and investigate any amounts they think are doubtful or just want to cross verify for investigation purposes. It is therefore correct to infer that the revenue and expenses that are directly transferred across the balance sheet wherein such amount requires them to put into either the capital account or retained earnings statement would initially require transitioning from a temporary statement that lists out the revenues earned and expenses incurred by the business.

How to Close Income Summary Account?

There are three broad steps that are involved in using and preparation of income summary account. As the first step, the revenue accounts have to be closed, wherein such balances would reflect credit balance the end of the financial period. The revenue accounts would be closed by giving the credit summary on to the income summary. A debit would be done to the revenue account, and the credit would be done to the income summary account. Once all the entries are passed, all the values in the revenue account would amount to zero.

The account for expenses would always have debit balances the closing of the accounting period. The account for the expenses would be closed by making the debit towards the income summary, and there would be a credit to the account for expenses. Once all the entries are passed, all the values in the expenses account would amount to zero. Finally, there would be entries in the revenue account balance aligned on the credit side as per the total income earned by the organization, and there would be all expenses aligned on the debit column of the income summary account, which would list down the total expenses earned by the organization. The business is said to make profits if the credit portion of the income summary statement is more than the debit side of the income summary statement. Similarly, the business is said to make losses if the debit portion of the income summary statement is more than the credit side of the income summary statement. In the final netted value column, whether a debit or credit, the amounts would then be transferred to the capital account of the business, and the parallelly, the income summary would be closed out or terminated.

Advantages

Some of the advantages are given below:

- It allows the listing of all the revenues and expenses in summarized form, and such forms are then used for the purpose of performance analysis.

- It can be used for variance analysis and budget analysis.

- It also helps in the easy filing of tax returns because it summarizes all income and expenses details in one place.

Disadvantages

Some of the disadvantages are given below:

- It comprises of both operating and non-operating income and expenses, and therefore it does not present a true picture for the organization on the financial front and position.

- It is made on an accrual basis, and it records the values irrespective of the fact the weather the business has received the money in their pocket or given the money out of their pocket.

Conclusion

The income summary is the summarized version of revenues earned by the business and the expenses incurred by the business. It is a temporary summary account, and the netted values are always transferred to the capital account of the income statement.

Recommended Articles

This is a guide to Income Summary Account. Here we also discuss the introduction and how to use the income summary account? Along with advantages and disadvantages. You may also have a look the following articles to learn more –

Which of the following accounts would be closed to the income summary account the end of Aperiod?

Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings. The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account.Which of the following accounts should be closed to the income summary account the end of the fiscal year?

Which of the following accounts should be closed to Income Summary the end of the fiscal year? The correct order for closing accounts is: revenue, expenses, income summary, withdrawals.Which of the following accounts should be closed to the income summary account?

The correct answer is A. Only expenses such as depreciation expense, and revenues are closed in the Income Summary...Which of the following accounts would be closed the end of an accounting period?

Only temporary accounts (revenue, expense, and dividends) are closed the end of an accounting period. Tải thêm tài liệu liên quan đến nội dung bài viết Which of the following accounts would be closed to the income summary account the end of period? Reply

Reply

3

3

0

0

Chia sẻ

Chia sẻ

Chia Sẻ Link Cập nhật Which of the following accounts would be closed to the income summary account the end of period? miễn phí

Bạn vừa tìm hiểu thêm nội dung bài viết Với Một số hướng dẫn một cách rõ ràng hơn về Clip Which of the following accounts would be closed to the income summary account the end of period? tiên tiến và phát triển nhất và Chia Sẻ Link Cập nhật Which of the following accounts would be closed to the income summary account the end of period? miễn phí.